Binghatti Holding Ltd has reported record financial results for the first nine months of 2025, driven by strong sales, early project handovers, and continued demand across Dubai’s real estate market.

Strong nine-month performance

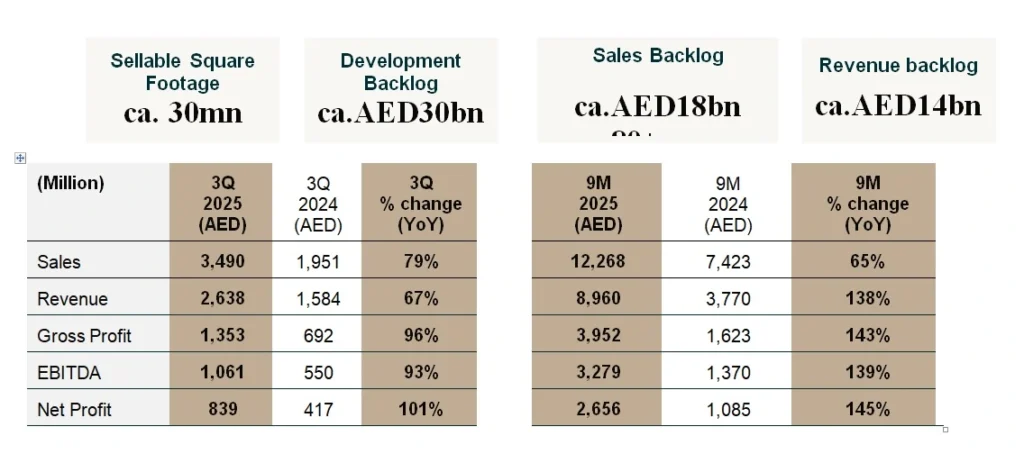

The UAE-based developer posted revenue of Dhs 8.96 billion, nearly three times higher than the Dhs 3.77 billion recorded in the same period last year. Net profit increased 145% year-on-year to Dhs 2.66 billion, supported by higher selling prices, efficient execution, and cost control.

Gross profit rose 143% to Dhs 3.95 billion, while EBITDA reached Dhs 3.28 billion, up 139% from 2024. The company attributed the gains to a balanced project portfolio and its vertically integrated business model, which it said has improved operational efficiency.

During the third quarter alone, Binghatti reported revenue of Dhs 2.64 billion, up 67% year-on-year, and a net profit of Dhs 839 million, compared to Dhs 417 million in Q3 2024.

Leading in unit sales

In the first nine months of 2025, Binghatti sold around 12,000 units, making it Dubai’s top-selling real estate developer by number of units sold. The company launched 11 new projects valued at Dhs 11 billion, adding over 7,000 residential units and 6 million sq. ft. of sellable area.

As of September 30, Binghatti’s revenue backlog stood at approximately Dhs 14 billion, backed by steady demand from both domestic and international buyers. Non-resident investors accounted for about 60% of total sales, reflecting Dubai’s continued appeal as a global investment destination.

Expanding project pipeline

Binghatti is currently developing 27 projects, up from 21 at the end of 2024, representing a 29% increase year-to-date. The active portfolio includes more than 20,000 residential units across 17 million sq. ft. of sellable area with a combined Gross Development Value (GDV) of Dhs 44 billion.

The company also has 11 projects in advanced planning stages, totaling 18,000 units and a GDV of around Dhs 30 billion. These developments are located in key districts including Palm Jumeirah, Nad Al Sheba, Al Jaddaf, Arjan, and Wadi Al Safa.

Financial position and funding

Binghatti’s total assets grew 73% year-to-date to Dhs 22 billion, while total equity rose 84% to Dhs 5.8 billion. Cash and cash equivalents more than doubled to Dhs 7.7 billion, and total debt increased to Dhs 7 billion, maintaining a debt-to-equity ratio of 1.2x.

The group reported margins of 44% gross, 37% EBITDA, and 30% net, placing it among the region’s most profitable developers. Binghatti also strengthened its capital structure with two sukuk issuances that were more than five times oversubscribed.

Recently, the company issued a USD 500 million Green Sukuk, dual-listed and dedicated to financing sustainable projects under its Green Financing Framework. Credit rating agencies Moody’s and Fitch reaffirmed Binghatti’s stable outlook, citing its strong liquidity and disciplined financial management.

Market outlook

Dubai’s property market continues to show strong fundamentals, supported by population growth, rising homeownership, and continued inflows of international investment. Long-term strategies such as the Dubai Economic Agenda D33 and the Real Estate Strategy 2033 are expected to reinforce the city’s economic base and housing demand.

Industry data points to steady absorption across key areas, with growing demand from first-time buyers and long-term residents. Binghatti said its integrated structure and disciplined project management will enable it to sustain momentum into 2026 and beyond.

tanvir@dubainewsweek.com