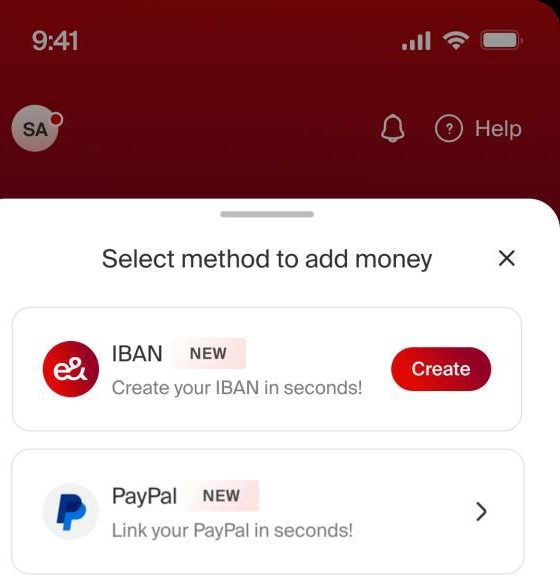

e& money, the fintech subsidiary of e&, will soon allow users in the UAE to link their accounts directly with PayPal, enabling instant withdrawals and access to PayPal balances in UAE dirhams (Dhs) through the e& money app. This move makes e& money the first digital wallet in the country to offer this direct connection.

Account linking and instant transfers

Once the service launches, PayPal users will be able to link their accounts to e& money and transfer funds instantly into their wallets.

The process includes converting US dollars to dirhams at a fixed exchange rate without hidden fees. A second phase will introduce two-way transfers, allowing funds to move back from e& money to PayPal. e& also plans to join PayPal World, a global network connecting major payment systems and digital wallets.

Supporting digital commerce

Otto Williams, SVP and Regional Head at PayPal Middle East and Africa, said, “The UAE continues to stand out as one of the world’s most dynamic markets for digital innovation. Partnering with e& demonstrates PayPal’s commitment to fuelling growth and opportunity for the future. By combining our global network and trusted capabilities with e&’s regional leadership, we’re empowering people and businesses to shop, send money, and transact across borders with greater ease than ever before.”

Melike Kara, CEO of e& money, added, “Cross-border commerce depends on fast, reliable payment rails. By joining forces with PayPal, we’ll be eliminating the friction freelancers, creators, and everyday consumers face when bringing their earnings into the local economy. This is what financial inclusion looks like in action: Instant, transparent, and secure.”

Benefits for users and the economy

Users will be able to access transferred funds within moments, 24/7, and use them for bill payments, peer-to-peer transfers, or cashing out via their bank accounts or the e& money card. Exchange rates and fees will be clearly disclosed upfront to ensure transparency.

The partnership aims to ease cash flow for freelancers and digital creators, who often face delays and costs with traditional payout methods. Consumers will also benefit from quicker access to PayPal funds for everyday expenses without waiting for bank clearing cycles.

On a broader scale, the collaboration supports the UAE’s financial inclusion goals and helps accelerate the country’s transition toward a cashless economy. This aligns with the UAE’s digital economy strategy, which targets digital commerce to account for 19.4 percent of GDP by 2031.

The announcement marks the first step in a longer-term plan. e& money and PayPal will continue to co-invest in marketing and product development to improve integration between global digital platforms and daily financial activities in the UAE.

tanvir@dubainewsweek.com